A frequent reader has pointed out to me today that our new preliminary GDP figures are out and they are beyond bad. Turns out the actual year-on-year GDP fall as of Q4 2010 was not 4% as originally anticipated by the IMF and our Government, or 4.2% as per the updated forecasts in January, but a whopping 6.6%. These are important, if preliminary figures, because they involve very significant changes to the previously released GDP figures. They are also not seasonally adjusted, which could mean that the true figure will not be anything like 6.6%.

Whatever the reason, these figures are even worse than my own forecast of -6%, which as you will recall was a pretty pessimistic estimate, even for me. But the point was simple. To me, the recession hadn't reached a turning point in Q2 2010 and therefore a naive extrapolation of the Q2 situation was as good as any rigorous estimate; better, it turns out, because my super-simple calculation did not need to accommodate my wishful thinking. As I explained back in the summer, the sovereign crisis really was just the beginning.

This brings to mind the words of the academics assembled at this event. One said, with all the audacity of an idiot who's marinated in vapid FT discourse until they can just about spew it out again, "I'll let you in on a secret. The crisis? It's over." He then helpfully told me to stop worrying and learn to love Government intervention. I'll let you in on a secret, dear reader. Economics is voodoo-ish enough without Business Administration PhDs trying their hand at it.

But more to the point, both our Government and its taskmasters have once again got their communications all wrong. As I have seen in the UK (and as they will tell you in Latvia), a country will ultimately get through even a really deep recession because, eventually, people (especially Greeks, I am tempted to add) have to eat and drink and take island holidays and take their girlfriends out. They have children and buy bigger homes. They crash their cars and buy new ones. Eventually everyone tires of hearing about how gloomy the economy is; the 'economy' is just an abstraction after all. They reach a point where most can no longer point to a friend or relative who is worse off now than three months ago, and the recession is then over.

Unfortunately, our Government's and our lenders' tactic has been to conceal the scale and scope of our concessions (lest they create widespread unrest and destabilise the Government), so we have to go through the same cycle of despair and recovery every time a new announcement is made.

Anyway the latest data are useful in one more way - they finally make some sense out of the final days of our previous government. The conventional wisdom is that the previous Conservative government decided to throw all caution to the wind in 2009 and spend like never before in order to ensure re-election for itself. So far, so plausible, but why did they need to go above and beyond what Greek governments generally do?

The new data suggest that, just as I was being lectured here on the virtues of the big state and the end of the downturn, the downturn had reared its ugly head in Greece, with quarterly (not annualised) GDP growth collapsing to a terrifying -3% (see below) in Q1 2009.

At first I thought this might be a data glitch, and it may well be - goodness knows our GDP series has had as much work done on it as the late Michael Jackson's nose. However, this is now supposed to be based on primary sources. More importantly, when I checked my other 'bad news' indicators, they all spelled out the same thing: unemployment jumped and the gap in unemployment rates between graduates and school leavers, natives and immigrants, widened dramatically. Essentially, the private sector in Greece had a massive coronary.

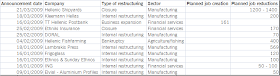

I thought I'd santity check this against the records of the European Restructuring Monitor, which contains details of all restructurings large enough to affect over 100 jobs and make the newspapers. Filtering only for restructurings announced in Q1 2009, it reveals some pretty big fish went under:

The shipyards are of course a massively iconic (and thus hideously distorted) sector but I suspect it's the layoffs in the press that really frightened the Conservatives. Having exhausted all possible means of flexible working and straight exploitation (not a word I use lightly in an employment context), publishers were finally laying people off - there really was no future.

That's a little piece of economic history I did not know; it makes little difference beyond satisfying my curiosity. But it just goes to show how bad things can get when panicked governments go for the 'hire' button as soon as something bad happens.

No comments:

Post a Comment

Please remember that I am not notified of any comments and will not respond via comments.

Try to keep your criticism constructive and if you don't like something, do tell me how to fix it. If I use any of your suggestions, you will be duly credited.

Although I'm happy to entertain criticism of myself in the comments section, I will not tolerate hate speech. You will be given a written warning and after that I will delete further offending comments.

I will also delete any comments that are clearly randomly generated by third parties for their own promotion.

Occasionally, your comments may land in the spam box, which may cause them to appear with a slight delay as I have to approve them myself.

Thanks in advance for your kind words... and your trolling, if you are so inclined.