[This post is still under construction]

Dear friends,

It’s been ages since I wrote a proper post; we’re long past apologies

so I’ll just explain that both my professional and personal life have become a

lot more demanding; staying up till 4 am is no longer an option. Still, I’m

aware I’m letting some people down and those of you who follow on Twitter

surely know there’s a lot I could be discussing here that I simply choose not

to. Please don’t take this the wrong way.

Still, some things need to be committed to the blog. A longtime reader has

written to me recently wondering whether it’s not time to update my old scenarios page, since the blog’s third anniversary, and the year

2013, were at the time nearly upon us. He’s right and I rather cherish the

opportunity.

PART I – EUROPE AND THE WORLD

The global economy grew by about $8.8tn between 2010 and 2012, which means that

despite slowing growth and significant amounts of money printing (and only modest deleveraging outside of the US and a couple of other

countries) it’s still roughly in line to grow into its balance sheet by around

2018. It’s particularly remarkable, though not surprising, how muted

deleveraging has been in Europe – even countries such as Greece are as laden

with debt as ever, juggling it between the private sector (where it can be

destroyed relatively easily) and the public sector (where it can be refinanced

relatively easily).

This will begin to change in 2013-14 as the laggards join the deleveraging party through private and sovereign defaults, 'voluntary' haircuts, bank resolution, fiscal austerity, and indeed whatever other means are available to them.

The Worst Decent Countries in the World

The hunt is still on for the

Worst Decent Country in the World - a position once held by Greece, which ensures never-ending demand for one's bonds regardless of short-term changes in the fundamentals, until the country blows up of course. Essentially we're looking for a country within the

'magic circle' of sovereigns that are seen as unlikely to default, but also riskier than the rest of their peer group of the same credit rating. The combination of higher yields for the same capital charge under Basel makes these bonds irresistible to banks.

As you can see on the graph to the right, Chile is currently

in the sweet spot among emerging markets, while Slovakia occupies the

same position among European sovereigns and

Australia and

New Zealand are soaking up demand in the Pacific. I should note here that I'm using the best-of-three credit ratings of sovereigns as opposed to any individual rating or a mean or median rating because best-out-of-three ratings are more closely correlated with bond yields than any alternative -

a consequence of Basel which still largely determines the dynamics of demand for sovereign debt.

The Eurozone dominos fall

Therefore, it doesn't matter what collective guarantees (ESM, EFSF etc)

its leaders come up with - the only effect of such guarantees will be to focus

attention on the ultimate guarantors (see here, here and here). The ultimate guarantors are in any case

France and Germany, and they can't bail everyone out; but investors are slow to

come to terms with such realities. They really want to believe in ultimate

creditworthiness just like some people want to believe in an afterlife. Therefore

the creditworthiness of France (as the weakest of the two) will be

tested now, not in one flight of vultures but gradually in the coming 2 years -

perhaps to its limits.

I don’t believe I got the magnitude of my original prediction right: I

warned of a humiliating downgrade and a significant rise in borrowing costs.

Sure enough, France did get downgraded by Standard and Poor's in January and by Moody’s in November (triggering a downgrade of the ESM and EFSF) and was put on negative watch by Fitch in December. By the end of 2013, it will no longer

have any AAA-rating left and will probably be on negative watch with at least

one of the Big Three, while French politicians will be fuming about evil

specuLOLtors and the like (why not? There are people out there stupid enough

to advocate a European Credit Rating Agency). And I don't mean Max Keiser by the way - although any man who writes this kind of stuff while on Putin's payroll will surely have no problem with EU governments rating themselves?

Contrary to my prediction, however, the market reaction to all of this

has been minimal so far, with France still paying historically low interest rates on its debt, making this carefully timed piece by the

Economist sound a bit shrill and, well, British. You see, as my yields-v-ratings graph above demonstrates, France's long-term debt is trading as though

it had lost its AAA-rating anyway (see right; ratings source; yields source), hence the lack of excitement.

Into the silicon core

Just as with Greece, it takes more than just fundamentals to

sink a sovereign; markets don't want to believe in sovereign

defaults, and the bigger the sovereign, the bigger and more aggressive the denial. So you need a combination of domestic events and contagion of some sort

- even Greece might have taken a while longer to blow without the Dubai

default, the 2009 elections and government audit, or the 2008 riots.

Now I'm less familiar with France's social dynamics than many readers, so I

won't bother trying there. Just read this whenever you can. I’ll stick to contagion, and it just so happens that we now have a proper set of data to help determine

who France is vulnerable to.

The top exporters of bond

yield contagion to France are Belgium, Austria, and the

Netherlands, according to this excellent report by N. Antonakakis and K. Vergos (see cheat sheet below). I’ve

ranked the three in order of contagion potential but also in reverse order of

creditworthiness. Somewhere between these three is what one might call the silicon core of the Eurozone supernova - that last stage of fusion before iron and kaboom.

Contagion from Belgium to France is my most likely nightmare scenario, for many reasons.

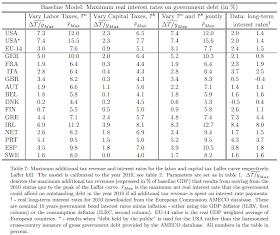

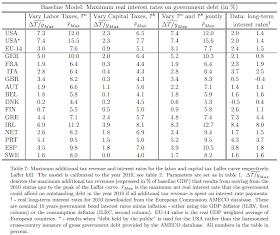

First, as the table to the right shows, Belgium is the non-PIIG most exposed to PIIG

contagion. Second, it is one of the Euro sovereigns least able to raise taxes - Belgium can only raise about 1.8% of GDP more in taxes than it did back in 2010, according to Trabandt and Uhlig (2012), which I discuss here.

Contagion from Belgium to France is my most likely nightmare scenario, for many reasons.

First, as the table to the right shows, Belgium is the non-PIIG most exposed to PIIG

contagion. Second, it is one of the Euro sovereigns least able to raise taxes - Belgium can only raise about 1.8% of GDP more in taxes than it did back in 2010, according to Trabandt and Uhlig (2012), which I discuss here.

Note, however, that according to these calculations, it will take real interest rates of 5.9% (or nominal of about 8.1%) to make Belgium insolvent - a long way off from today's below zero real rates, perhaps, but it took Greece just under a year and a half to cover this distance in basis points during our own sovereign debt crisis. I would say that, from the moment Belgium seriously hits the headlines, this is the amount of time it will take for France to be in trouble.

Note, however, that according to these calculations, it will take real interest rates of 5.9% (or nominal of about 8.1%) to make Belgium insolvent - a long way off from today's below zero real rates, perhaps, but it took Greece just under a year and a half to cover this distance in basis points during our own sovereign debt crisis. I would say that, from the moment Belgium seriously hits the headlines, this is the amount of time it will take for France to be in trouble.

Finally, as you can see on the table to the right (source here), Belgium is up to its neck in bank

guarantees – at 84.2% of GDP its guarantees are more extensive than Greece’s,

or indeed any other European nation’s apart from those of Ireland and, oddly

enough, Denmark. Famously, Belgium and France share an interest in the now-nationalised Dexia, with Belgium shouldering just over half of the bank's troubled assets and the repeated bailouts of the bank as well as underwriting its short- and medium-term financing. All this for a bank that still has more than a fifth of its credit risk exposure tied up in the PIIGS. Add these contingent liabilities to Belgium's debt and it doesn't look so sound anymore. Especially since it's about to go into

recession.

And did I mention secessionist politics? And a recent history of being

ungovernable? So there you go folks, Belgium is the link between France and the PIIGS and the link is about to tighten into a noose in the next two years.

The plot, of course, thickens. As per our contagion cheat sheet above, any trouble in Belgium bad enough to truly reflect on France will first have to bounce off Austria - Belgium's no. 1 importer of contagion and incidentally France's number 2 source of contagion too.

Recall that Austria, despite its generally healthy-ish financials, has more debt (as a % of GDP)

in the hands of foreigners than Italy, which is why Italy keeps dodging the debt crisis bullet. Austria also has an additional problem - high exposure to Eastern Europe, where Austrian banks often

dominate the market. So a perfect contagion storm will involve rising NPL rates in Eastern Europe coupled with sovereign debt pressure on Belgium, all of which could happen in 2013. Based on the latest data on non-performing loans, I'd say watch out for bad debt in

Croatia and

Romania.

The Roadmap to Nowhere

2013-14 will be the years in which the EU's massive drive towards federalism hits a significant roadblock. By this I don't mean the usual cases of UK Euroscepticism or even the knee-jerk reactions of bailed-out countries. I mean a proper, mainstream current of integration skepticism. The beginnings of this were already evident in late 2012, when EU leaders delivered their

road map to fiscal and economic integration.Check out the chorus of disappointment from federalists

here and

here, and an amazing analysis closer to my own heart from

Protesilaos Stavrou here.

You see, apart from their dangerous assumption that Europe is collectively solvent, Europe's leaders and many of their cheerleaders are also mistaken in believing that a federal Europe would be seen as a saviour by the hard-pressed peoples of Europe.

I must concede that Europeans' desire for a faster-integrating 'Europe' has never been more ardent (see right), and it's important to note that this desire has risen fastest in the countries

worst hit by austerity (see p. 70 here). This should be great news for federalists.

But in fact it isn't. For the first time ever, the European institutions have actually been unpopular in net terms since November 2011. And this isn't me talking, it's the Eurobarometer itself (this is also where the Eurodynamometer data for the first graph have come from). The

interactive search tool provided by the EB website is a treasure trove of information but I particularly like the graphs to the right.

Anyway, the folks at Gallup have looked at the data in some detail in the

latest edition of the Eurobarometer and seem clear that only France and Germany have registered marginal increases in faith in the European Institutions - and

not all of them either.

So let me get this straight - people, especially in austerity-hit countries, want

more Europe. In practice, though, more Europe is only ever delivered by

more powerful European Institutions. But people, especially in austerity-hit countries,

also want

less of the European Institutions! Any guesses what it is that the

Sainted People of PIIGland (and eventually other countries too) want?

Correct. They want money. Other people's money. The people will be sold 'Debt Relief Europe' and will end up with something completely different from what they were hoping for. Presumably armchair federalists will queue up to explain how wrong this perception is and manage expectations? Probably not. They will campaign, as Prof. Varoufakis

does, for the ECB to hoover up Europe's debt instead, and for the EIB and EIF to take up (and dramatically boost) its collective investment budget. As I'll explain later, I believe they'll see at least part of their wishes come true.

Rethinking austerity

Perhaps the biggest fiscal policy shift of 2012 was the IMF’s admission (right) that fiscal multipliers were much larger during recessions than it had assumed in the recent past – about three times as large in fact. One way of interpreting this is to say that ‘austerity doesn’t work,’ but I beg to differ.

Perhaps the biggest fiscal policy shift of 2012 was the IMF’s admission (right) that fiscal multipliers were much larger during recessions than it had assumed in the recent past – about three times as large in fact. One way of interpreting this is to say that ‘austerity doesn’t work,’ but I beg to differ.

First, it shows that any bubble sustained for long enough is bound to build a rent-seeking (and supposedly private) sector around it, much like a coral ecosystem will colonise the hull of a sunken ship. Second, it shows that countries with easy access to liquidity must take advantage of this luxury to adjust slowly – but not take it for granted and avoid adjustment. Essentially, fiscal slippage is a bit like

Captain Hindsight – it reminds governments many years down the line that they should have made the tough calls earlier, when their economies were still growing.

Then again, high levels of both leverage and public sector spending mean that even very mild doses of austerity can plunge countries into recession – when further austerity presumably becomes unsustainable. The result is that it’s probably too late for most OECD countries to turn their public finances around – those that are not trapped in austerity are instead merely prisoners of their liquidity, until this runs out of course.

To cross-reference this, it's useful to look at

this excellent paper looking into the demand for 'developed' country sovereign debt, and particularly the two graphs on the right:

Essentially, these suggest that are only four OECD economies in the world right now that are enjoying the dubious luxury of both maintaining very high levels of debt and delaying austerity - the US, the UK, Germany, and Japan. Even France has spent much of the last couple of years on the naughty step, although demand for its debt has since improved substantially.

The rest will just have to suck it up and keep cutting. However, they will probably learn from the examples of Greece and others that, while levying taxes is easier and quicker than cutting government spending, it must be avoided at all costs as the effects of tax hikes are much worse than those of cuts. In fact, the best experiments will likely be with a combination of cuts to both tax and spending - effectively returning more income to the private sector, as opposed to government or its debtors.

The rest will just have to suck it up and keep cutting. However, they will probably learn from the examples of Greece and others that, while levying taxes is easier and quicker than cutting government spending, it must be avoided at all costs as the effects of tax hikes are much worse than those of cuts. In fact, the best experiments will likely be with a combination of cuts to both tax and spending - effectively returning more income to the private sector, as opposed to government or its debtors.

The figures below (presented here, an event in which I ended up replacing one of the speakers) show the level and content of consolidation planned by OECD countries from 2012 to 2015 – some of this will by now have come to pass, but most remains to be delivered. Note that the smaller the initial level of consolidation, the more countries have relied on spending cuts. But once a country tries to cut more than 2% of GDP per year – more or less – it becomes very difficult to deliver consolidation without relying significantly on tax increases too. And then, as readers will recall, there’s a limit to how much countries can tax too – Italy, for instance, simply

cannot deliver the amount of tax revenue planned for 2015 no matter what the government does, so prepare for more fireworks. Essentially, austerity will both fail and triumph over the next two years. Country after country will join the club and country after country will see their best-laid plans succumb to fiscal slippage.

With austerity failing to reduce the debt burden in much of Europe, I believe the consensus is likely to shift in favour of better spending, not necessarily less spending. In particular, I believe that public investment will receive a substantial boost in austerity-hit countries, but tied to substantial conditionality. The rationale behind this is that, with monetary policy at its current super-accommodative levels, public investment provides better stimulus than public consumption (see meta-analyses of fiscal multiplier studies here and here).

With austerity failing to reduce the debt burden in much of Europe, I believe the consensus is likely to shift in favour of better spending, not necessarily less spending. In particular, I believe that public investment will receive a substantial boost in austerity-hit countries, but tied to substantial conditionality. The rationale behind this is that, with monetary policy at its current super-accommodative levels, public investment provides better stimulus than public consumption (see meta-analyses of fiscal multiplier studies here and here).

This is where Varoufakis and other Federalists will begin to see their wishes granted. In fact, the EIB has somehow seen fit to give us a

recap of its support for Greece recently, while the EIF is thinking mostly in

regional terms. This is in any case just the beginning. Together the two sister institutions have one of the last remaining AAA-ratings in Europe; they are going to use it.

6 September 2012 will be remembered by many as the

Day the Bundesbank Died. The novel

Outright Monetary Transactions (OMT) mechanism effectively allows the ECB to buy unlimited amounts of Eurozone sovereign debt from the secondary markets, provided these purchases

are sterilised through sales of other bonds. A very detailed roundup of the critical reception of OMT can be found

here. I believe I can add three points to this.

First, I'm sure I'm not the first person to point this out but sterilisation is an aspiration; it depends on finding enough buyers for the bonds one is trying to sell, at the time when one needs to sell. More importantly,

it's failed before and will fail again, except on a larger scale. When it does, the markets will smell inflation.

Second, if the OMT is anything like the ECB's previous bond market operation, the SMP, then it could fail to work in the manner described. Remember, the ECB is not trying to finance sovereigns though bond purchases, hence its commitment to staying within the secondary market. The OMT is, rather, supposed to fix securities markets enough for the ECB to be able to do its job. You see, that was the idea behind the SMP too. Its

explicit purpose (see

here too) was to restore the monetary policy transmission mechanism by 'addressing the malfunctioning of security markets' through additional liquidity. R-iiiight. Importantly, as the Eurosystem is, after all, made up of the national central banks, this meant that it was up to them to purchase as they saw fit.

Unfortunately, a

recent evaluation shows that this was not the way purchases really worked. . It wasn't liquidity that drove purchases, the researchers say: it was yields. Yields explained 85% of the variation in purchases. Here's what they have to say about this, in detail:

"We conclude that the ECB applied rather simple “rules of thumb” when purchasing Greek sovereign bonds. Most notably, it focused on bonds with larger outstanding volumes and higher yield spreads. In contrast, bond liquidity does not seem to be systematically related to bond purchases. Our findings also suggest that ECB bond purchases had a large causal effect on the yield spreads of the bonds that it purchased. These findings may be relevant for policymakers, as well as for investors currently holding distressed bond of Eurozone peripheral countries."

So, essentially, the ECB was targetting its purchases in order to increase the prices of PIIGS bonds. Simple.

But there is a bigger problem here, which I don't think many people have pointed out. Unless the ECB is

very careful, sterilisation could itself exacerbate sovereign risks. Bear in mind, t

he ECB can only purchase the debt of a bailed-out country under the OMT. So suppose Belgium asks for assistance. Given what we now know about the France-Austria-Belgium triangle, the ECB would never try to sterilise Belgian bond purchases with sales of French or, even worse, Austrian debt, because that would drive up

their yields and end up pushing Belgian bond yields back up. Of course it would presumably never sell PIIGS debt (no buyers, very bad politics, the list goes on), although that's arguably what it

should do, to minimise the amount of contagion back to Belgian bonds. It can only sell Core country bonds, and preferably those of a big sovereign with fairly liquid bonds. If, on the other hand, it relied on countries like Germany too much for its sterilisation practices, it would face an outcry. So it's France to the rescue again, with a hint of contagion spilling back out to Belgium but also to the rest of the Eurozone. To cut a long story short, the ECB would effectively have to save peripheral countries at the terrible price of weakening the already weak guarantees holding the Eurozone together. Good luck with that.

PART II: GREECE

Greece is no longer a problem - everyone else is

One consequence of the findings of Antonakakis and Vergos (2012) is that Greece is now broadly insulated

from the rest of Europe, with bond yield spillovers from Greece to the rest of

Europe and vice versa at truly minimal levels. In fact, the countries

that are both most vulnerable to Euro-contagion and best placed to contaminate Europe

right now are Belgium, Italy and Spain, in that order.

Put simply, none of the things happening in Greece are now likely to create contagion in Europe. This is because Europe now has a plan for

fiscal consolidation, a safety net of sorts for sovereigns and banks and a banking

union underway, as well as a more activist Central Bank than people would have

expected a year ago.

As you can see on the graph to the right, Chile is currently in the sweet spot among emerging markets, while Slovakia occupies the same position among European sovereigns and Australia and New Zealand are soaking up demand in the Pacific. I should note here that I'm using the best-of-three credit ratings of sovereigns as opposed to any individual rating or a mean or median rating because best-out-of-three ratings are more closely correlated with bond yields than any alternative - a consequence of Basel which still largely determines the dynamics of demand for sovereign debt.

As you can see on the graph to the right, Chile is currently in the sweet spot among emerging markets, while Slovakia occupies the same position among European sovereigns and Australia and New Zealand are soaking up demand in the Pacific. I should note here that I'm using the best-of-three credit ratings of sovereigns as opposed to any individual rating or a mean or median rating because best-out-of-three ratings are more closely correlated with bond yields than any alternative - a consequence of Basel which still largely determines the dynamics of demand for sovereign debt. Contagion from Belgium to France is my most likely nightmare scenario, for many reasons.

First, as the table to the right shows, Belgium is the non-PIIG most exposed to PIIG

contagion. Second, it is one of the Euro sovereigns least able to raise taxes - Belgium can only raise about 1.8% of GDP more in taxes than it did back in 2010, according to Trabandt and Uhlig (2012), which I discuss here.

Contagion from Belgium to France is my most likely nightmare scenario, for many reasons.

First, as the table to the right shows, Belgium is the non-PIIG most exposed to PIIG

contagion. Second, it is one of the Euro sovereigns least able to raise taxes - Belgium can only raise about 1.8% of GDP more in taxes than it did back in 2010, according to Trabandt and Uhlig (2012), which I discuss here.  Note, however, that according to these calculations, it will take real interest rates of 5.9% (or nominal of about 8.1%) to make Belgium insolvent - a long way off from today's below zero real rates, perhaps, but it took Greece just under a year and a half to cover this distance in basis points during our own sovereign debt crisis. I would say that, from the moment Belgium seriously hits the headlines, this is the amount of time it will take for France to be in trouble.

Note, however, that according to these calculations, it will take real interest rates of 5.9% (or nominal of about 8.1%) to make Belgium insolvent - a long way off from today's below zero real rates, perhaps, but it took Greece just under a year and a half to cover this distance in basis points during our own sovereign debt crisis. I would say that, from the moment Belgium seriously hits the headlines, this is the amount of time it will take for France to be in trouble.

But in fact it isn't. For the first time ever, the European institutions have actually been unpopular in net terms since November 2011. And this isn't me talking, it's the Eurobarometer itself (this is also where the Eurodynamometer data for the first graph have come from). The interactive search tool provided by the EB website is a treasure trove of information but I particularly like the graphs to the right.

But in fact it isn't. For the first time ever, the European institutions have actually been unpopular in net terms since November 2011. And this isn't me talking, it's the Eurobarometer itself (this is also where the Eurodynamometer data for the first graph have come from). The interactive search tool provided by the EB website is a treasure trove of information but I particularly like the graphs to the right. So let me get this straight - people, especially in austerity-hit countries, want more Europe. In practice, though, more Europe is only ever delivered by more powerful European Institutions. But people, especially in austerity-hit countries, also want less of the European Institutions! Any guesses what it is that the Sainted People of PIIGland (and eventually other countries too) want?

So let me get this straight - people, especially in austerity-hit countries, want more Europe. In practice, though, more Europe is only ever delivered by more powerful European Institutions. But people, especially in austerity-hit countries, also want less of the European Institutions! Any guesses what it is that the Sainted People of PIIGland (and eventually other countries too) want? Correct. They want money. Other people's money. The people will be sold 'Debt Relief Europe' and will end up with something completely different from what they were hoping for. Presumably armchair federalists will queue up to explain how wrong this perception is and manage expectations? Probably not. They will campaign, as Prof. Varoufakis does, for the ECB to hoover up Europe's debt instead, and for the EIB and EIF to take up (and dramatically boost) its collective investment budget. As I'll explain later, I believe they'll see at least part of their wishes come true.

Correct. They want money. Other people's money. The people will be sold 'Debt Relief Europe' and will end up with something completely different from what they were hoping for. Presumably armchair federalists will queue up to explain how wrong this perception is and manage expectations? Probably not. They will campaign, as Prof. Varoufakis does, for the ECB to hoover up Europe's debt instead, and for the EIB and EIF to take up (and dramatically boost) its collective investment budget. As I'll explain later, I believe they'll see at least part of their wishes come true. Perhaps the biggest fiscal policy shift of 2012 was the IMF’s admission (right) that fiscal multipliers were much larger during recessions than it had assumed in the recent past – about three times as large in fact. One way of interpreting this is to say that ‘austerity doesn’t work,’ but I beg to differ.

Perhaps the biggest fiscal policy shift of 2012 was the IMF’s admission (right) that fiscal multipliers were much larger during recessions than it had assumed in the recent past – about three times as large in fact. One way of interpreting this is to say that ‘austerity doesn’t work,’ but I beg to differ. To cross-reference this, it's useful to look at this excellent paper looking into the demand for 'developed' country sovereign debt, and particularly the two graphs on the right:

To cross-reference this, it's useful to look at this excellent paper looking into the demand for 'developed' country sovereign debt, and particularly the two graphs on the right:  The rest will just have to suck it up and keep cutting. However, they will probably learn from the examples of Greece and others that, while levying taxes is easier and quicker than cutting government spending, it must be avoided at all costs as the effects of tax hikes are much worse than those of cuts. In fact, the best experiments will likely be with a combination of cuts to both tax and spending - effectively returning more income to the private sector, as opposed to government or its debtors.

The rest will just have to suck it up and keep cutting. However, they will probably learn from the examples of Greece and others that, while levying taxes is easier and quicker than cutting government spending, it must be avoided at all costs as the effects of tax hikes are much worse than those of cuts. In fact, the best experiments will likely be with a combination of cuts to both tax and spending - effectively returning more income to the private sector, as opposed to government or its debtors. With austerity failing to reduce the debt burden in much of Europe, I believe the consensus is likely to shift in favour of better spending, not necessarily less spending. In particular, I believe that public investment will receive a substantial boost in austerity-hit countries, but tied to substantial conditionality. The rationale behind this is that, with monetary policy at its current super-accommodative levels, public investment provides better stimulus than public consumption (see meta-analyses of fiscal multiplier studies here and here).

With austerity failing to reduce the debt burden in much of Europe, I believe the consensus is likely to shift in favour of better spending, not necessarily less spending. In particular, I believe that public investment will receive a substantial boost in austerity-hit countries, but tied to substantial conditionality. The rationale behind this is that, with monetary policy at its current super-accommodative levels, public investment provides better stimulus than public consumption (see meta-analyses of fiscal multiplier studies here and here).

It's a little bit cheeky (and perhaps ever so slightly dishonest intellectually) to bundle together what's happening in the Eurozone with currency sovereign nations like US/UK. Your analysis of austerity and how it works suits very well a pseudo-gold standard regime such as the Eurozone but really has no use for modern fiat money regimes. The amount of "demand" for sovereign debt in the case of the US or the UK is simply related to the tastes of people for liquidity vs yield. It is completely unrelated to the probability of the sovereign defaulting on its debt, especially since that probability is always, by definition, exactly zero.

ReplyDeleteAusterity policies in a currency sovereign nation (e.g. UK) in order to combat some hypothetical "run by investors" or some fuzzy danger of "Zimbabwe inflation" when unemployment hovers around 8%, is nothing but medieval misanthropic superstition. (just like flagellating ourselves to make the plague go away)

Yiorgos

@Yorgo

DeleteI'm sure you'll notice I've made no claims about the drivers or outcomes of austerity in the US or the UK. In fact in 2010 I mentioned the UK's own currency as one of the reasons it is being spared what France is about to face.

Still, I know the point was to ease your way into an ideological rant and get a rise out of me (with that hint at intellectual dishonesty) so I'm not going to demand too much relevance.

You may want to consider the implication of your worldview though. I would refer you to a recent post (not mine, unfortunately) on the changing nature of sovereigns as seen through the looking glass of the financial industry.

http://coppolacomment.blogspot.fr/2013/01/when-governments-become-banks.html

A quick summary of my objections:

a) people can (and do) refuse to accept currencies, especially non-reserve currencies.

b) no asset is 100% safe, inflation being but one of the risks, and saying that anything is safe 'by definition' nearly guarantees you're working at a dangerous level of abstraction

c) taxes are the ultimate backstop to both debt and currency issuance and they cannot be levied indefinitely. It's just a matter of exchanging the gold standard for the 'tax revenue standard'.

Following your rationale to its logical conclusion, the main function of the state becomes to supply the risk-free securities that the financial industry craves - itself a dangerous way of thinking verging on the misanthropic, but also entirely dependent on banking regulation remaining forever faithful to the disastrous (and crisis-inducing) Basel framework. Banking has not historically staked its very existence on risk-free assets; indeed if it had it would not exist today as sovereigns have rarely been able to provide such.

Assuming a) b) and c) are not an issue, you are right. They aren’t for most AAA-rated countries with their own currencies *for now* and policy acts accordingly (with the UK as a moderate outlier). However, it’s one thing to acknowledge this (I do), another to pretend that Government borrowing doesn’t need to match investors' preferences for yield with actual returns on public spending (i.e. increases to tax revenues as a result of higher spending). If it fails to do so then it cannot help but reach a point where it’s impossible to tax more, impossible to get people to accept more currency and indeed impossible to impose austerity either, as it will simply cause the entire edifice to implode. This is what I mean when I say these countries are prisoners of their own liquidity.

This is the endgame to which your rationale leads, and it leads there necessarily, if one assumes diminishing (tax revenue) returns to government spending. Returns may be able to match the current appetite for rock-bottom yields, itself a product of financial repression. But they cannot always do so.

Finally, the idea that inflation is incompatible with high unemployment IS in fact superstition of the kind you accused me of. It is like claiming that one cannot be a fascist because one is left-wing. Just as the latter is a product of misunderstanding Politics 101, so is the former a product of misunderstanding Economics 101.

A reading of inflation as simply 'the price of a basket of goods going up' doesn't tell the whole story; so does a reading of hyperinflation as 'an uncomfortable amount of CPI inflation'. Nor is it of course true that hyperinflation must, or indeed usually does, coincide with high capacity utilisation.

My own brief experience of the UK property market, to name one example, suggests to me that it's entirely possible for asset prices to be inflated by monetary policy (and make life extremely difficult for the population, especially the poorest) despite high and indeed rising unemployment. Sure, CPI is low but ask people whether the cost of living has risen substantially and anyone without a variable rate mortgage taken out in the noughties will say hell yeah.

Thanks for responding Manos.

Delete1. You claim that the natural endgame for governments who spend beyond their tax intake is meltdown through hyperinflation. I do not really see the logical necessity but all I can say is that historically it almost never happens like that. Even economic basket case, Greece, managed to trundle along in the 80s, printing drachmas to cover deficits. Of course there was inflation and of course zeros were wiped out occasionally to keep things under control but was there meltdown? Was there complete cessation of economic activity? No. In fact history has shown you need stronger things like civil war and wholesale destruction of production capacity before Zimbabwe or Weimar can happen. At the very least, the "taxation standard" you are talking about is a much fuzzier regime than the gold standard that austerians are pretending we live in. So it would be a good start if we can only agree to ditch all that scaremongering from the public discourse and get everybody to accept how government budgets really work.

2. Ultimately, if we cut through to the crux of our disagreement, I agree this is a world-view problem. I see the main function of the state to be the management of society's "commons" as well as the diversion of resources into things we can all agree are important. The function of monetary policy on top of all that is to provide people with a necessary quantity of "consumption tokens" that can then mobilise productive capacity that is currently lying hopelessly idle. Your view is that this would cause inflation and erode people's hard earned "wealth". I don't think it would, and at any rate this should be the main debate of our times.

3. Of course you can have unemployment AND inflation. If I carpet bomb half the factories in your country you will get left with an army of unemployed workers, half the previously available goods and the same number of money tokens chasing them (a.k.a. inflation). Is this what's happening in our economies according to your world-view?

Your point about the UK housing market (and other similar bubbles) actually supports my view rather nicely. Credit expansion (a bad bad policy decision as it turns out) meant that people could borrow up to 10 times annual income to pump into a housing purchase. Now for many reasons the UK housing market had been running at 100% capacity (no new housing projects, aversion of Britons for high rise buildings etc). It is totally understandable how this would lead to price inflation in that sector, irrespective of what unemployment does. Same as any other bubble, ultimately it can be traced to bad policy decisions; we still need sound policy you see, no society can be left on autopilot unfortunately.

What *is* medieval superstition is when David Cameron uses these bubbles as arguments for, say, halving of NHS resources or removing child benefit for middle incomes. I am not saying these policies are right or wrong, lets have voters decide, but using the hyperinflation/Zimbabwe argument to convince people is just wrong. Sorry.

Yiorgos

@Yiorgo,

DeleteYour apology is accepted but let's see what you did wrong first.

1. actually I claim the natural endgame is as follows.

"If it fails to do so then it cannot help but reach a point where it’s impossible to tax more, impossible to get people to accept more currency and indeed impossible to impose austerity either, as it will simply cause the entire edifice to implode."

What then happens is up to the sovereign. It can try to spend more and face a hostile bond market unwilling to lend at affordable rates or at all, or try to spend less despite fiscal slippage and trigger deflation. Either way it fails. Your argument would have to be that sovereigns with their own currencies *never* reach this point, unless perhaps through fiscal self-flaggelation.

You can beat up a straw man of course but don't expect me to shout 'touche!' when its head comes off. Moreover, if you have a bone to pick with David Cameron you go and do that, friend. I'm not a messenger. Sure I believe the UK will not be able to spend as it has indefinitely, so perhaps that's your problem with me. So did most of the electorate actually; all three parties promised austerity, with slightly different focus and timing. Zimbabwe didn't come up from all angles, you'll note. But perhaps everyone is not well enough versed in MMT or whatever the fashion is these days.

2. As you say, the Greek money supply was growing wildly throughout the 80s (starting 82, I don't have earlier figures): http://appsso.eurostat.ec.europa.eu/nui/show.do?query=BOOKMARK_DS-050070_QID_-7462BDF6_UID_-3F171EB0&layout=TIME,C,X,0;MNY_AGGR,L,Y,0;GEO,L,Y,1;S_ADJ,L,Z,0;UNIT,L,Z,1;INDICATORS,C,Z,2;&zSelection=DS-050070INDICATORS,OBS_FLAG;DS-050070S_ADJ,NSA;DS-050070UNIT,PCH_SAME;&rankName1=S-ADJ_1_2_-1_2&rankName2=INDICATORS_1_2_-1_2&rankName3=UNIT_1_2_-1_2&rankName4=TIME_1_0_0_0&rankName5=MNY-AGGR_1_2_0_1&rankName6=GEO_1_2_1_1&pprRK=FIRST&pprSO=PROTOCOL&ppcRK=FIRST&ppcSO=ASC&sortC=ASC_-1_FIRST&rStp=&cStp=&rDCh=&cDCh=&rDM=true&cDM=true&footnes=false&empty=false&wai=false&time_mode=NONE&lang=EN&cfo=%23%23%23%2C%23%23%23.%23%23%23

During that time real per capita GDP fell and after years of stagnation Greece qualified in every way for the status of a Great Depression victim http://asset2012.org/web_papers/Day3/VanghelisVassilatos_1.pdf

How did Greeks get over that? Mostly by changing their standard of living in a way they cannot repeat. Credit swelled in; people had fewer children, more women entering the labour market, more people working second jobs, more public spending to remedy the worst of the injustices brought about by more public spending, and yet more leverage. We were able to do this due to an initially low household and government debt load and then the low interest rates guaranteed by EMU. Now we can't.

3. Your point that the UK housing market is in its current state because credit standards were lax and supply was insufficient misses the point dramatically. To test one number you quoted, the average multiple of borrowers' wages represented by mortgage advances in London was 3.08 at its highest, up from 1.94 in 1969. See table 29 here: http://www.ons.gov.uk/ons/rel/hpi/house-price-index/october-2012/rft-annual-oct12.xls

Table 39 will also show you that deposits kept rising as a % of purchase price, hardly the scenario you had in mind.

To this day, prices are refusing to budge because both monetary policy and government incentives are propping them up:

http://www.guardian.co.uk/business/nils-pratley-on-finance/2012/oct/19/funding-for-lending-well-heeled-cheaper-mortgage

http://www.guardian.co.uk/business/2012/dec/29/first-time-house-buyers-at-five-year-high

Excellent job mate! Continue like that. I trust your crystal ball lol lol. May I ask you something? Do you have rss?? I want to add your site in my reading lists in order to get feeds. I searched but couldn't find it.

ReplyDeleteThanks in advance.

http://lolgreece.blogspot.com/feeds/posts/default?alt=rss

DeleteRegarding the IMF paper describing the contractionary effects of austerity - contractionary policy is contractionary - I think the distinction between countries who control their own currency and countries who do not is crucial. All euro members, with perhaps the exception of Germany, are essentially borrowing in a foreign currency, and their bonds are treated as credit instruments.

ReplyDeleteFor pretty much all countries with independent monetary policy, the threat of a bond vigilante attack or hyperinflation (and allow me to quote you as saying in 2010 that hyperinflation is "coming any day now") has yet to materialize, despite the dire warnings of many policy makers and the Wall St. Journal Op-ed section. I find this to be a clear vindication of the liquidity trap model, which essentlially says that, in a depressed economy, low interest rates do not mean that the market is rewarding you for being fiscally sound but that investors have nothing better to do with their money given how the demand for saving skyrockets. However, for countries who do not control their own currency, the risk of default is very much real, thus driving away capital. A very interesting result of this is evindent if you compare the yields of Sweden and Finland: While for years they traded at almost identical levels, there has been a clear divergence since the euro crisis broke out.

And since you mention government spending, the increase in public deficits is the result, not the cause of the crisis for most countries. If you exclude Greece, all other PIIGS had much better public finances than Germany had in 2007. And even in the US, despite the wars and tax cuts of George Bush (I always forget where all those fiscal conservative Republicans were hiding from 2000 to 2008, perhaps the same place Germans went on vacation from 1939 to 1945?), deficits soared as a result of increases in non-discretionary spending in response to the deep depression. It is clear that those safety net deficits were what prevented 2008 from turning into 1929 all over again. And the story of the UK shows what the costs of implementing austerity amidst a deep recession truly are.

Finally, the notion that inflation can occur from "money printing" while in a liquidity trap has also been refuted, since despite monetary bases multiplying in size, inflation has remained under control. And for any tinfoil hat wearing reader who thinks the Man is fudging with the inflation numbers, independent inflation metrics, such as the MIT billion prices project, confirm this view.

Again, all these points lead to the same point that, for the greater parts of 2010 and 2011, with the pinacle being the ECB's decision to RAISE rates in the spring of 2001, this notion that austerity would stop bond vigilantes and restore confidence was the mainstream view amongst policy makers. While it seems that even Germany is now willing to concede how wrong this mantra is, I guess the biggest challenge for Europe is a political one. Fiscal stimulus essentially means fiscal transfers, which comes back to your point of what European integration means to most Europeans: Give us your damn money. At least I am happy to say that it's one step ahead of the US, where the majority of people who oppose fiscal stimulus, also known as Republicans, are NET RECIPIENTS of federal money, either on an individual or State level.

Dimitri,

DeleteYou will just have to wait and see I'm afraid.

Some facts first.

1. The only PIIGs that were in a better state than Germany in 2007 were the ones that experienced massive property crises which sank their banking sectors (Ireland and Spain). They have, throughout the crisis, been a different class of problem country altogether. See for yourself:

http://bit.ly/Sgn64Q

2. Can we simply accept that sovereigns issuing their own currency and off the gold standard *have* become unable to get people to buy their debt in the past? Or are there none? I can start listing examples if you'd like and we can go over the case studies together.

As I said, I believe highly leveraged sovereigns are trapped either way: they can never stop spending and incurring debt, as *any* decrease in spending will reduce their revenues disproportionately and send them into a tailspin without much debt reduction to show for it.

Except of course some run out of investors willing to buy their debt, and therefore run out of any other options.

You're telling me this cannot happen to sovereigns issuing their own debt; presumably in the very end their own Central Banks will monetise all debt as it is issued and yet somehow everyone, both foreign and local, will still feel the need to hold their currency. Please tell me you believe this so we can have you on the record.

I'd say people *might* do this for the issuer of a reserve currency, if they have a massive army to back THAT up, and if they don't have urgent demographics stacked up against them. Anyway people *wouldn't* have done this for an extra-EMU Greece back in 2008 or 2001, but equally they won't always be willing to do this for the US, either.

You tell me that in the current environment investors are essentially piling into safe haven bonds (not all of the own-currency bonds are benefiting, mind you) because they can't find better risk adjusted yields than the negative ones on offer.

I dare say that's only reasonable if they never leave the house. It's a big world out there Dimitri are here you are assuming they not only cannot find better risk-adjusted returns *now*, but by implication that they will *never* be able to, either. To me a number of things are forcing institutional money into these supposedly ultra-safe assets. I'll give you no points for guessing, but number one is Basel. Basel III has forced banks worldwide to hoover up ultra-safe securities that will never risk becoming illiquid (some 2-4 trillion of them according to this http://www.imf.org/external/pubs/ft/gfsr/2012/01/pdf/c3.pdf). Not to mention of course, it really IS increasingly central banks that have to do much of the buying in secondary markets; their share isn't going down very fast, is it? It should be, if you're right. Add to this indefinite QE on all sides and hey, why wouldn't you buy? You don't fight the Fed right?

To cut a long story short, I think you're wrong in a megacycle-wrong kind of way and the amount of damage your way of thinking is going to do to the world is incredible. Quite how this is about Obama vs. Republicans is hard for me to understand. The discussion would be happening exactly the other way round if Obama weren't in power, and would be equally stupid; except of course Krugman would have to take a sabbatical to avoid grinding his teeth.

And of course we're still going to be arguing the point after all of this shit goes down. I'm not happy to retreat into non-specific prophecy, but to me this is as clear as it can be.

The way I see it, if you're right, eventually every country will adopt your view and you'll get your way. If I'm right, some countries will delever badly now and others will delever worse later. So let's wait. I will of course keep writing in the meantime and you can write whatever you think back at me.