Dear readers, critics and trolls:

I've spent a lot of my time in the last few months debunking conspiracy theories, responding to populist bullshit and generally being contrary to a lot of the popular sentiment in Greece. I am happy to take on this role as I feel it's desperately needed and I enjoy it most of the time because I feel genuine contempt for some of the people I criticise (though not all, and I hope the difference is discernible).

However, it is often the assumption of critics in Greece and elsewhere that enemies of enemies are friends etc, and that since I lambast populist MUPPETS who denounce the IMF and the memorandum I must, by inverse association, be an IMF apologist or "memorandum cheerleader" as one commentator put it. Here's some news for my critics: any idiot can criticise the IMF and the memorandum, and many idiots do. Don't make assumptions on where I sit ideologically just because I don't agree with populist bullshit.

Still, I would like to very briefly set the record straight on this one in one post that I can use in future as a handy reference. Here goes.

I am

on the record as saying, back in May 2010, that Greece is insolvent and will have to default.

I am on the

very public record as saying, back in July 2010, that Greece was bailed out to save European banks, not Greece itself, and that the bailout was only a temporary liquidity measure, when our problem is solvency. I explained back then that a massive recession was on its way and that there's no reason to expect anyone to lend to post-memorandum Greece who would not lend to pre-memorandum Greece, as the country will be more indebted and less capable of growth; hence the importance of reform. Finally, I pointed out in that interview that default has been historically proven to be a workable solution to a solvency problem and is an option for Greece. I still believe this, although people have to realise that timing the default is crucial and getting people to demand one right now is not going to help.

What I believe of the IMF is, first and foremost, that its intervention is tantamount to a loss of sovereignty (hence my 'Vassal State' references), which needs to be reversed as soon as possible (though note that as soon as possible does not mean 'now'). Had I been asked in a referendum, or if I had been an MP at the time, I would have voted in favour rather than accept a forced disorderly default and would have supported that decision even in hindsight. I actually also believe that any debt incurred under the IMF in excess of the original plan is in fact

very close to odious and thus fair game for default because it has nothing to do with the will of the people. I have been very quick to sign a

petition for an audit of Greece's government debt, even though I strongly disagree with the way the matter has been treated by Debtocracy.

That said, I agree with some of the IMF's programme, including liberalisation of the labour market and the professions, privatisations and of course with fiscal austerity itself. I wish less emphasis was placed on tax and public investment and more on benefit reform and government consumption. I also believe that the IMF reforms that I do support should have come at the urging of the Greek people, not some outside agency. If we can't do it for ourselves, we'll only reverse it when the IMF is gone.

My view is that the IMF's proper role is to administer an orderly default in Greece, a role which they are refusing to perform properly because they

lack the right theoretical or practical tools. It doesn't help that

no one in power can openly admit that Greece will have to default - least of all the IMF. Still I think the IMF realise their plan doesn't work and have resorted to openly

fudging the numbers.

A libertarian's instinct is quite simple in these cases: insolvent debtors (like Greece) must be allowed to default and creditors must be allowed to take their losses without compensation. That's how it's supposed to work. I do believe this but I also think that human nature introduces some constraints - make people too miserable too quickly and they will turn back the clock by decades. The closest I can think of to a good compromise is bail-ins, and I've

called for this to be our primary response.

I am

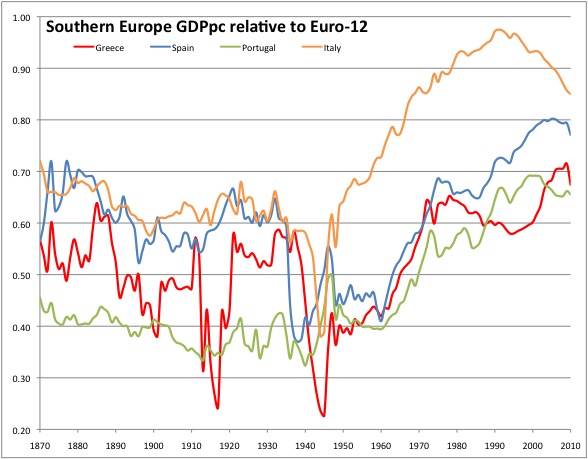

on the record as demonstrating that the cost of internal devaluation without substantial reform will be enormous, throwing living standards back to the late 60s. However, I also realise that unilateral withdrawal from the Euro would be

enormously costly and even impossible. This means that I believe in striking a deal with Brussels and Frankfurt which would involve the entire European banking system.

The deal I would like to see would be based on bail-ins, forcing creditors to accept equity stakes in debtors which would then allow calmer markets to price in the right level of default - Europe would only have to use its bailout tools in order to ensure no one takes an equity stake in sovereigns. I am also a big fan of Europe

advancing future subsidy money to us instead of handing us any further loans, which will help, in the post-default world, to ensure that we are weaned off the corrosive influence of European subsidies and might actually increase FDI.

I have

written before that the purpose of bailouts is to give one party (usually the Government but others too) some time to reallocate losses from a default away from the people they want to protect. In this case, the EU and IMF were always going to opt to protect European banks, and the Greek government would opt to protect their constituents - which is not to say the Greek people; just that part of the Greek people that they think are important to their re-election. Although if I'm honest, it's up to the Greek people to put pressure on the Government with regards to who needs protecting. To me the

optimal scenario now is one in which we use the bailout to buy time to return to a primary surplus - after which point we default on as much of our debt as we can get away with.

The reason I am so hell-bent on an orderly v. a disordely default is two fold. First, because we need to be able to finance ourselves after the default. If we give the wrong signals, we could be shut out of markets for many years and if we don't have a primary surplus that will mean more pain (see

here).

Second, unlike Dubai or Iceland, or even Ireland come to that, Greece has been relying on its current unsustainable model for 30 years. All of our social structures, all of our politics and all of our economy are tainted by its poison. Remove the loose supply of debt and there isn't readily something else to prop up the way we live. And while letting the political system collapse is appealing to me, letting household finances collapse is not. People say in response that the Greek people can't possibly suffer more in default than they are suffering now. If you believe this, then you haven't travelled very much and are probably less imaginative than you think.

Finally, I believe that, in the long run, publicly traded government debt is

a very small subset of our government liabilities and that without reforming the liabilities created by our welfare system we will not become truly solvent even if we somehow manage to default on all of our debt in one go. That's another reason why I don't like the defaultnik literature in Greece - they don't seem to realise that the problem is much wider than the evil machinations of our creditors.

What do I think of the Greek people? We are no better or worse than the Swedes, the Germans, the British or the Zimbabweans. We respond to incentives and when incentives are skewed we act in ways that are harmful to ourselves and others. The role of the state in Greece has been so warped for so long that generations have been born and died believing that the role of the Government is to run the country, rather than the State. Like any other nation, Greeks don't like tradeoffs and it is the role of the political leadership to make tradeoffs explicit while seeking ways to overcome them. Ours did not. They simply pretended they do not exist.

I do believe, however, that freedom comes at the price of vigilance and the Greek people have not been vigilant enough or have accepted corruption in return for personal gains. There is no point at which the Greek political system forces people to choose one party or the other, and elections are free. Sure, the media will come up with their own propaganda in favour of major parties, but frankly it is the citizen's job to see through it. We know who owns the media and can take note of what they do and do not report. Plus in the age of the internet, media oligarchy is no excuse (nor is it a viable business model). I've spent the last five years not watching the Greek media and I still get all the information I need, thank you very much.

This doesn't mean that the Greeks somehow deserve some kind of punishment. Simply that we shouldn't blame outsiders. It does mean however that we are bound by the Government. If you don't like how much power the Government has to bind you into spending and debt, then vote consistently for whoever promises to reduce this power. We have not. Tough shit.

This is a reversal of the Greek saying, "The fish stinks head first", meaning that the leaders are to blame when things go wrong. I don't believe this. Sticking with the analogy, I believe it's relevant when you are a fishmonger but irrelevant if you are the fish, which can only be all alive or all dead but nothing in between.

Nor do I believe that surplus nations have some kind of

moral high ground over us. They respond to incentives just as we do. Their incentives are skewed in favour of production; ours in favour of consumption. If we were to swap places they would only act as we do.

I believe in the Rule of Law. I believe that once you denounce that it's Good Morning Zimbabwe in a flash. I believe that it's right and imperative to punish those who have broken the Law, and that we should strive to change the Law so that what is generally believed to be unacceptably immoral is made illegal, subject to evidence of the public's beliefs - via referendum if necessary - and respect for human rights, or else we'd end up making things like homosexuality and atheism illegal.

However, I do not believe that we can expect the Law to punish anything beyond what the Law prescribes, or apply new laws retroactively. If the Courts do not apply the law, then we need to pile pressure on the Government to clean them up. Have we ever demonstrated for a truly independent judiciary? Not in my memory. Another case of failure in vigilance and such a crucial one at that.

While we're waiting for the Courts and the Law to change, it should be social, rather than legal, sanctions that we shoudl use to make things right. The first of these are dinner table sanctions, which we failed to apply - did society shun known tax dodgers in private interaction? Or people with non-jobs in the public sector? Or champagne socialists? Or irresponsible employers? Or the Far Right? Was this stuff brought up at the dinner table? Well if it wasn't it should.

I also believe that we should refrain from the Greek hobby of netting off social ills. Two wrongs don't make a right. If regulation makes it too hard to employ people, we should relax regulation. If businesses get around this by illegally abusing the employment relationship, we should crack down on them. We should not accept one as a pressure valve for the other and tolerate it by turning a blind eye and permitting the other. The same argument works with tax and tax evasion.

Similarly in our misguided tribalism we net off wrongdoing by one faction against wrongdoing by another. If the police are being brutal and have too much latitude in carrying out their duties, we should rein them in, sharpish. If a small part of our anarchist population think torching people alive is fun we should catch them and bring them to justice. But suggesting that the two somehow net off, or that one side is more 'right' if the other side is more brutal is tribal pointscoring bullshit and people should wear bells for indulging in it.

Finally, I believe in Parliamentary Democracy. No I don't believe ours works. I believe in Proportional Representation, which keeps parties on their toes and forces them to learn to compromise and build bridges. But to denounce the whole thing is ludicrous. Look at the happiest places on earth, or the most equal, or the most just. Their system is more similar to ours than to any spurious notion of Direct Democracy. DD works for whichever 200 people in Syntagma are close enough to the Assembly to take the floor and vote, but it doesn't work for 12 million people. I am happy to be proven wrong. The closest we can get is referenda, and I am entirely in favour having those; we don't have enough as it is. As long as we realise that the will of the people can change and are mindful that we don't get locked in to what people believed at one time forever. All of this should be written into our Constitution so that the Greek people can trigger a referendum relatively easily. We cannot, as things stand, and that's wrong.

So this is what I believe. Please leave comments if you disagree and I will try to update this to explain as many of my views as possible.