I've

promised before to write more about the Grand Bargain for Greece agreed in late July - the latest bailout to end all bailouts. I'm still working on material for a new post but for now, here's one I prepared earlier.

What follows is an article I prepared for ACCA's Financial Services e-newsletter. It is written from a UK perspective but readers may still find it of interest.

Greece – can we look now?

Part I: The Exposure

On 21 July 2011, the leaders of the Eurozone nations announced to what must have felt like the entire world that they had reached a deal on a new rescue package for Greece, one that would reduce the country’s borrowing costs and outstanding debt, ensure its continued liquidity and hopefully set Greece back on the path of fiscal sustainability. They stressed that this is a one-off package, and that other embattled countries could not take it as granted that they would be offered the same.

What does this deal mean for the UK? The place to start answering this question is the exposure of UK banks to Greece. Now people tend to play with words when this question comes up, including in Parliament itself. For a start, it’s important to distinguish between exposure to Greek banks, exposure to Greek sovereign debt and claims on the Greek private sector, and then exposure to the much broader risk of contagion in the case of a Greek default. The good news is that there are definitive figures out there. The bad news is that they are dated and problematic in multiple ways.

Stashed away in the detailed tables of the latest Quarterly Review from the Bank of International Settlements is a detailed, if dated, answer to the question of direct exposure. As of December 2010, the UK banks’ total exposure to Greek public and private debt was $14bn. But less than half of this, around $6bn, was exposure to Greek government debt or Greek banks, where the risk of losses is greatest. Overall, UK banks appear to only carry about 2% of the total Greek exposure of European banks.

This brings me to an important point. For the purposes of accounting profits and losses, the allocation of Greek bonds between the banks’ banking books and their trading books (which alone must be marked to market, leading to recognised losses when bonds lose their value) is crucial. Non-Greek banks typically hold about 31% of their Greek bonds by value to maturity, so most of their exposure is already marked to market – the banks will have recognised significant losses on them already. This is important because bonds bought at a deep discount may appear to be taking a haircut under a buyback scheme (the much-celebrated 21%) while in fact turning a profit for the banks participating in the swap. Coming back to RBS, for instance, the bank would recognise a profit of ca. £275m on this transaction. As a Greek, I feel a little cheated, but as a UK taxpayer... ka-ching!

Now for the wider question of contagion and what it might mean for UK banks. To be fair, the contagion is already happening, so this is pretty much a moot point. But it’s easy to dismiss this as mere panic, an irrational response. That’s until one realises just how interconnected the European banking system is, and how exposed the UK is, through various different routes, to the contagion seeping out of Greece.

According to the BIS data I cited above, UK banks have a $22.8bn exposure to Irish banks and the Irish sovereign; another $20bn to banks and sovereign debt in Italy; another $6.8bn in Portugal; and a whopping $30.7bn in Spain. And the $80bn this adds up to are just the obvious risks, the black sheep of the European financial family. Given that the European stress tests earlier this year estimated the Core Tier 1 capital of the major UK banks for 2011 at about $300bn even in an adverse scenario, a substantial impairment of assets in the most troubled Eurozone countries would cause significant problems for them although it wouldn’t wipe out their capital. Still, there is no telling where the contagion would stop and indeed which other sovereigns and banks might follow should the PIIGS go.

This is why we must turn to the bigger picture.

Part II: Is the Eurozone insolvent?

Throughout the various stages of the European debt crisis, the argument has been made that, if only the Eurozone could co-ordinate fiscal policy and issue debt collectively, for instance via Eurobonds, it would put an end to all this drama of speculation and contagion – Europe would become a borrowing superpower and no one would ever dream of doubting its creditworthiness.

The idea that a fiscally unified Europe would be undeniably creditworthy is wrong on many levels. Superpower status, fiscal union, and indeed fully-fledged federalism, didn’t stop S&P from downgrading the US to AA+ earlier this summer. Perhaps more importantly, given who buys US debt nowadays, it didn’t stop the Chinese rating agency, Dagong, from downgrading the US to A with a negative outlook. Some might say that these downgrades reflect the mechanics, not the fundamentals, of US debt, and that’s fair enough. But even if Eurozone members can somehow be coerced into fiscal union (and they may well be in the following months) the delays and horse-trading involved in drawing up a collective Budget for the Eurozone will make the debt ceiling negotiations in the US seem like an elegant costume drama ball.

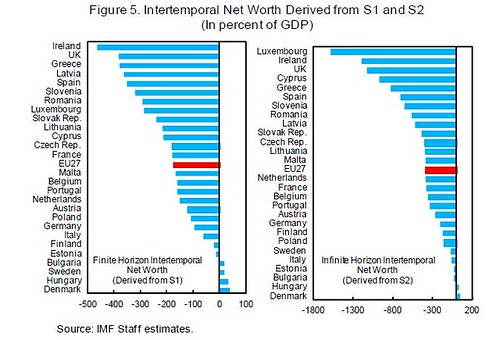

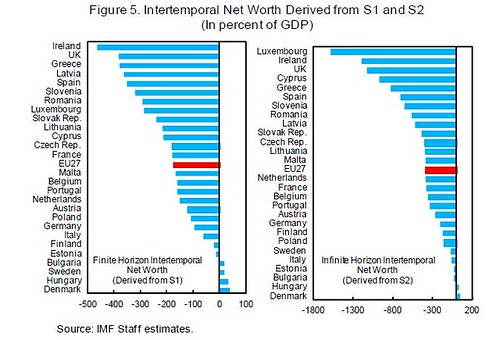

But it is the fundamentals, not the mechanics, of debt that truly worry the markets. In the Eurozone as in the States, policymakers may not want to countenance the thought that the entire bloc might be collectively insolvent. Yet for over a year this question has been preying on commentators’ minds. The IMF even did the math on this in a fascinating report last year that went largely unnoticed. They found that the Eurozone, mighty Germany included, is not, in fact, solvent in the long term. According to the IMF calculations, the only long-term solvent countries in Europe were Hungary and Denmark. Bulgaria and Estonia were also strong candidates, but that was about it. The news for the UK were particularly grim.

Markets also find it hard to think of sovereign nations as being insolvent; much of the world’s financial architecture rests on the assumption that there is a magic circle of ‘decent’ sovereigns that can never default, and this belief has persisted after the 2008-9 crisis despite ample historical evidence to the contrary. The only difference is the ever-retreating boundary of the magic circle, as each embattled sovereign puts pressure not only on those countries that are financially exposed to it, but also any country seen as equally or less ‘decent’. Right now, the magic circle includes very few countries beyond the small group of AAA-rated sovereigns, and the result is a AAA asset bubble that could pop with disastrous consequences.

European policymakers are increasingly testing the surface tension of this bubble. Consider the European Financial Stability Facility (EFSF). Caught up in their own rhetoric of being under attack by evil speculators, Europe’s politicians hailed it as a shield for the Eurozone. But market participants, still smarting from the experiences of 2007 and 2008, quickly identified it as no more than a massive Collateralised Debt Obligation (CDO) and treated it accordingly. The market tested first the junior, then the mezzanine, and finally the senior tranches (see also here and here) of this construct – the guarantees by France and Germany. The very existence of the EFSF prompts the market to do this, much like the very mention of fiscal integration prompts the question of the Eurozone’s collective solvency. This in turn explains the ever-diminishing half-lives of Eurozone initiatives to calm the markets.

Until the markets are convinced that Europe’s finances are sustainable, this drama will continue to play itself out regardless of what schemes are concocted by its leaders, and will claim ever more, ever more conspicuous victims. Long-term sustainability trends can be reversed more quickly than one would think – relatively small changes can add up to a lot over a 50-year horizon. But they do not reverse themselves.

Thanks for sharing this quality information with us. I really enjoyed reading. Will surely going to share this URL with my friends.

ReplyDeletedebt relief program