• NUMBERS ARE PEOPLE • COCK-UP BEFORE CONSPIRACY • CITE PRIMARY SOURCES OR GO HOME•

Tuesday, 23 November 2010

MÁ ÓLAIM AN T-AIRGEAD IS MÁ BHRONNAIM AN T-ÓR ...

Nov 21 was the day that Ireland finally stopped battling the waves and took the EU's money, joining Greece in the naughty step of protectorate-dom and plunging into an abyss of political instability. And there is worse news closer to home: turns out Greece won't be getting additional time to pay off our EU/IMF loans as it turns out those nasty Germans don't like the thought of us defaulting on their claims so early in the game.

The bailout of course failed to put anyone at ease regarding the fate of the rest of the European periphery. It did however cheer up big government apologists in Greece and elsewhere, who are already chanting the moral of Ireland's story: that austerity is self-destructive as it couldn't save the IMF's star pupil, that low taxes

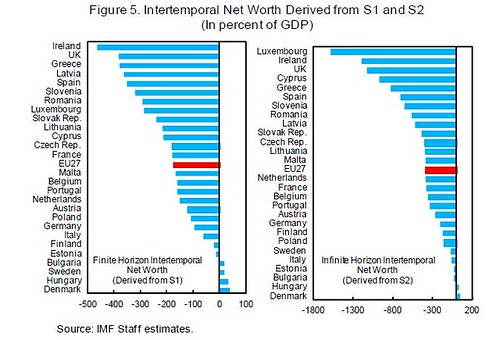

They are right almost as much as they are wrong. In Greece and Ireland, banking on a crash course of austerity on the IMF's terms to get our economy growing again and bring our debt down was never going to work because both countries were clearly insolvent. The IMF death list can be seen clearly on the left below:

Technically, the UK should also have followed us into the bottomless pit by now but they have their own currency and central bank which does allow them a bit of leeway - perhaps enough for them to avoid a default but who knows?

With the UK temporarily out of the way the next EU member on the IMF's stochastic death list is Spain. Now the Spaniards will argue until they are blue in the face that they aren't Ireland or Greece but actually they combine the worst of both worlds - sharing as they do both Greece's hideously sclerotic labour market and Ireland's property-obsessed cult of suicide bankers. The only way in which they are unlike the previous two is that Spain is very, very large - so large in fact that the EU bailout fund cannot save it.

On the other hand, Portugal might be next. They are technically much better off than Spain (i.e. ranked lower on the death list) but they might attract more attention as they are a smaller country and because point-scoring politicians in the Portuguese opposition have just hit the market with some scary numbers. Always a bad idea putting numbers to bad news. It makes people reach for their excel sheets and update their models.

What people refuse to understand about the chain of sovereign defaults is that it isn't troubled European countries that are defaulting - it's the whole system. Spain will not be saved because its debt is 'only' 53% of GDP as opposed to Ireland's 65% or Greece's 127%. The simple truth is that no one believes Europe can grow fast-enough, in a credit-constrained world and without irresponsible levels of government spending, to get itself out of debt. One can spend all day arguing that a jet fighter is faster than a DIY Red Bull Flugtag plane or a seagull, or that one weighs more than the others, but all three must eventually come down because none of them can reach escape velocity.

Until three years ago, the consensus was that European sovereigns could not default, period. Last year, the consensus became that European sovereigns could never really default, except through inflation. Earlier this year, it became 'clear' to us all that the periphery could indeed default. Now markets are waking up to the fact that even larger and 'safer' European sovereigns could default. Portugal is, as per the Death List, more solvent than France and much more solvent than the UK. It's only market participants' superstition and their love of guarantors that is keeping them from betting on the obvious.

Back to the IMF for a second. Given that it compiled the Death List in the first place, surely the Fund (or its staff) know what's going on, even if they can't admit it in review after review of our adjustment mechanism?

Perhaps this paper written by the IMF's own staff is meant to give us a hint.

7 comments:

Please remember that I am not notified of any comments and will not respond via comments.

Try to keep your criticism constructive and if you don't like something, do tell me how to fix it. If I use any of your suggestions, you will be duly credited.

Although I'm happy to entertain criticism of myself in the comments section, I will not tolerate hate speech. You will be given a written warning and after that I will delete further offending comments.

I will also delete any comments that are clearly randomly generated by third parties for their own promotion.

Occasionally, your comments may land in the spam box, which may cause them to appear with a slight delay as I have to approve them myself.

Thanks in advance for your kind words... and your trolling, if you are so inclined.

Remember how i said that Ireland would never satisfy the IMF and would need a bailout?

ReplyDeletemacroeconomics 101: cutting G and increasing T reduces GDP, making any reduction of G futile as governmemt expenditure increases by bank failures and unemployment benefits. maybe they stoped teaching this in Chicago? of the IMF has different macroeconomics books than i do?

@Alex

ReplyDeleteI really think austerity does make markets happy if you have a solvency problem without a liquidity problem (the case of the UK and the US, and even Greece until 2009). It can buy countries like that more time to deal with the underlying solvency problem.

In theory, IMF-style bailouts aim to temporarily remove the liquidity problem so that you can win back the markets with your austerity programme.

However, this ignores the reason that countries can be fundamentally insolvent without being illiquid. It is because speculators tend to group together a small number of countries as 'decent' and generally refuse to believe that these can possibly default until it becomes 1000000% obvious that they will. This is a genuine cognitive bias, very powerful stuff. Once you are thrown out of the group of 'decent' countries the years of denial catch up with market participants in a very short and traumatic time.

The risk is that by the time the IMF moves in the country has come under so much scrutiny from the markets that it can't go back to the 'decent' group in anyone's mind until something very dramatic has changed.

Now as for the IMF's logic, I think the big error is that it and many other stakeholders don't seem to think (yet) that bondholders need to pay for their bad decisions. That could be a) the banking industry's lobbying dollars at work or it could be that b) people really believe bailing out countries is cheaper than bailing out banks or c) people really believe banks can make money quickly enough to recapitalise by themselves.

I'm sure in Chicago they do teach that a bad investment needs to lose you money or else moral hazard arises. But their disciples in the worlds of finance and politics don't like hearing that last part.

The latest announcement from Brussels (extending the bail-out) should be music to Greek ears though; and to think that it's all thanks to the Irish! No more sleepless nights in Athens pondering how to find EUR 146 billion for repayment in 2013-2014. I'm somewhat sceptical though of PASOKs ability to make use of this breathing space constructively; rather than fall for the temptation of slacking off further with necessary reforms.

ReplyDelete@Andreas: I honestly don't know how the Socialists will respond to this.

ReplyDeleteIn fairness they have what support they have either because of die-hard PASOK voters or because of voters who believe the current programme is what we need. I don't think they will risk losing many of either group if they fail to make use of the 'breathing room' provided by an extension.

More to the point I don't think we will be allowed such discretion - it will introduce moral hazard to an enormous degree.

On the other hand, I suspect that, given the enormous new global recession that is now underway, PASOK may try to maintain the line of credit with the IMF and EU even if they don't actually believe we need it - as Ireland's example shows, the terms aren't getting any better.

"On the other hand, I suspect that, given the enormous new global recession that is now underway..."

ReplyDeleteDude, since I really value your analyses, give me your best prediction of events over the next couple of years. I'd love to read it, mull it over and respond with my own. Like everybody else, I love the intelligence, healthy scepticism and sense of humour you treat us readers to on your site. Have a nice weekend.

@Andreas, you are too kind. I've gone over some Greek scenarios offline with another reader but the list of caveats to those was big enough. The truth is that I don't like forecasts because they invariably fail and I don't like looking ignorant afterwards.

ReplyDeleteI do, however, like a good nightmare scenario and I can definitely come up with some of those. Watch out for a scenaria page if I can find the time.

@Andreas: Global forecast is on the way: http://lolgreece.blogspot.com/p/teh-biig-pik-chur-u-can-haz-macro.html

ReplyDelete