But the common denominator for most is that they all start the story too near to the present day. Euro accession; the last Conservative government; the financial crisis. It's easy to fit a couple of years to the trend one has in mind, and yet miss the point spectacularly.

Take a look at this graph, showing the trajectory of Greek debt/GDP. This is the stuff your narrative has to account for. Where would you start telling the story?

Sources: IMF (database overview and dataset), recent data (2012 onwards) updated from Eurostat, forecasts from the OECD, IMF and European Commission.

I do not intend to write an economic history of modern Greece in this post. Only to fill in the gap the majority of commentators won't touch. Hopefully readers will do their own research and beef this up.

You see, as precipitous as the rise in national debt has been over the last couple of years, it is still amateur stuff compared to the way we piled on the debt between 1981, the year of Αλλαγή, the Change, ushered in by a massive 48% majority, (Time coverage here) and 1993, when the Maastricht rules finally started to bite and we were forced to pull the handbreak on our burgeoning government budget.

[Note than in 1993 the massive growth in the stock of debt is due to Greece being forced to recognise a big chunk of previously off-balance sheet debt, most of which was built up in the 80s. The actual deficit was much smaller than the jump in liabilities would imply.]

The years between 1981 and 1993 were, despite the protests of deathbed convertees and defaultniks, the years in which the Greek people were the most politically active. Voter turnout in those years was the highest we've ever had - reaching an eye-watering 84.5% in 1989. The politicians didn't sneak this debt past us and onto the nation's balance sheet; we watched them do it and urged on. Worse, once the gravy train ground to a halt, the Sainted People suddenly lost interest in centrist 'politics' altogether. The first elections after that, in 1996, were a washout, with voter turnout collapsing and only the parties of the non-governing Left gaining any ground at all.

Data source: Institute for Democracy and Electoral Assistance.

And incidentally the years under Big Spender A-Pap just so happened to be the times in which the Greek people were the happiest with the state of Democracy in Greece. Apart from the time when we were hosting the Olympics; you know, the ones Debtocracy claims were a massive scam and somehow made a decisive difference to the dynamics of Greek debt.

If you're still in doubt as to whether 1981 was a popularly endorsed change of course, have a look at the video below. You will find that the crowds gathered in the centre of Athens put our current protests to shame. Yes that is our current Prime Minister's dad. The irony would be delicious if we didn't have to pay a terrible price for it.

The Greek people's dilemma in 1981 was framed in the most polarised of terms, as a battle between the Establishment of the Privileged v. Change for the dispossessed (more reading here). The goal of both sides was to capture the State, the ultimate redistributive mechanism. The Sainted People chose the latter by a landslide.

Within a single year, the Keynesian dreams of the Socialists had descended into disappointment (see a sympathetic but critical review here) and a new consensus began to be forged. As Spourdalakis puts it:

"the long standing problems of productivity and competitiveness of the Greek economy were to be solved through labour's 'responsible participation' in established tripartite corporatist bodies which would guarantee 'social peace' with wage concessions."The year this Grand Bargain was born was, incidentally, also the year that I was born. One of the most popular ever Greek governments opted not to fix our fundamental competitive problem, but to placate all sides by buying them off. Were the People disappointed? No. In 1985 the socialists won another landslide victory (with a 46% majority) and the saga of the Socialists' οκταετία, the Eight-Year-Rule, was written. The Grand Bargain worked well enough to seduce both parties, Socialists and Conservatives, and an evolved version of it survived up until 2009. This is despite the fact that the Greek eighties technically qualify as a Great Depression; per capita GDP remained stagnant, despite a soaring debt load and money supply. The second half was, if anything, even worse than the first, because the Greek banks finally caught on to the game and public sector spending started to seriously crowd out private investment.

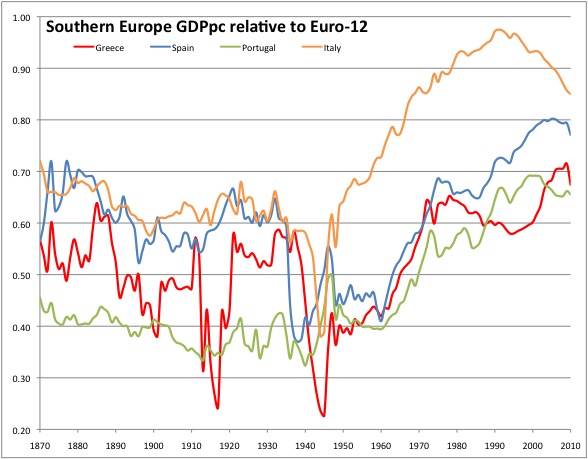

In this epic post, Pseudoerasmus looks into the realities of The Change, and sees a shift from Post-War Orthodoxy to 'Democratic Peronism.' I cannot go into all the details of Pseudoerasmus' argument here (you have to read it for yourselves, and I hear there's a sequel on its way!), but I wanted to focus on one of the post's graphs, based on Maddison Project data. As you can see below, Greece lost ground not just relative to the Eurozone core (as it would later become) during the 80s, but also relative to the rest of the periphery.

Save for a short period of fiscal consolidation meant to qualify us for Eurozone membership, which, contrary to the flawed hindsight of some, was in fact wildly popular in Greece (see pg. B 29 here and here), we never dropped the Grand Bargain until 2010. We only changed the way it was financed, with the EU and debt markets pitching in to pick up the slack from the overtaxed population. Some people will, upon reading about the smoking gun story of Goldman helping us disguise some of our debt in this process tend to decide they have heard all they need to know and that somehow it was Wall Street that spoon-fed us this debt. Well, there's no helping some people.

In fact, it was the Basel Accords, one after another, that spoon-fed European and other banks our debt, but this is such a long story that it deserves its own post.

Back to our story. By 1993, Greek debt had cleared 100% of GDP and the foundations of the current crisis had been laid. Now, sustaining that level of debt is not impossible, but it is very difficult; it takes a great deal of growth and/or inflation, and as inflation is a terrible tax on the poor and essentially uncontrollable, it was mostly growth that we depended on. By that time, the Greek economy was so dependent on high growth that any slowdown at all was going to be a disaster. Then came the biggest global recession in years, and the rest is history.

Sure, the story goes on, but by that time the dynamics of the Greek fiscal crisis were fixed. Did we have the chance to change course? You bet, long ago. But we didn't.

UPDATE: Commentators seem to be getting their knickers all tangled re: the amount of public spending that trickled down to the people.

I can only refer them to my review of Debtocracy for the figures: left graph shows gov't spending as a % of GDP, right graph shows spending on civil servant salaries (blue) and social benefits (red) as % of government spending.

Eurostat's data don't go back to 1981, which would have been amazing. But you can check the timing of corruption vis a vis the Change by looking at how measures of our underground economy grew during that time (source):

UPDATE: Regarding the data unearthed by our friend @epanechnikov: First of all, many thanks. One objection though. Although this is one very cool table (not least because it shows that PPP-adjusted income in Greece was higher, pre-crisis, than that of Germany, which is simply ludicrous), I should point out that, ceteris paribus, the poorer a population the greater the percentage it tends to direct to consumption of necessary goods and services, assuming similar levels of social security provision (lest someone quote China to me). Similarly, the poorer a population, the greater the percentage of consumption directed towards food (Engel's Law). I'm not sure the Turks, Romanians and FYRoMacedonians were overconsuming.

A better way of testing consumption is in terms of consumption spending per adult equivalent adjusted for purchasing power, as follows:

This makes more or less the same point but in much less extreme terms: in 2005 Greece's real consumption level was almost exactly at the Eurozone average. Higher than Denmark's, almost the same as Sweden's, and WAY higher than Spain's or Portugal's. Still, without median consumption data we still can't properly argue this point. Perhaps these figures are skewed by a small number of extremely wealthy people - but then again income inequality is only marginally higher in Greece than in Spain and lower than in Portugal (data here) so I'm not sure that is the whole story.

.png)

Great post, loved the video. I am having so much fun with people's theories and conspiracies on the origin of Greek debt. Last week I was speaking with a 50-year old housewife who was telling me of the huge oil deposits in the Aegean and was complaining that the Jews and Americans do not let us extract us. Yesterday a friend of mine told me that Putin offered us a 100bn Euro loan at 1% interest rate. As for myself, I am looking for salvation from team Epsilon. No wonder we are still paying 700m Euros annually to plug the gap at PPC's pension fund...

ReplyDeleteI must admit your blog is quite refreshing and different from all those who present the rioters as heroes defending their country from "banker occupation".

ReplyDeleteCorrect me if I'm wrong, but (my) view from Canada is that, like in so many other places, the state is always very happy to spend and buy votes with unborn people's money and Goldman's help in hiding the debt was very helpful for those politicians.

Rioters present themselves as victims of a foreign takeover, but is it right to say that most of them profited lavishly from out of hand social spending while the gravy-train was still on its rails ?

I do not think that the issue was ever phrased in those terms, until too late [2008 ?]. Not everyone is an economist, and yes, people want generally to have secure jobs, something which in the eighties was within their reach for the first time in Greek history [I never voted PASOK or ND, and I consider myself an indignado]. Also, you seem to suggest that the causation is majority-political change -debt. What if the causation is corruption or non-democracy - debt - majority ? The greedy oi polloi forced the debt on the country, or the elite bought a fragile consensus by buying off a critical mass of voters [never a majority, lest we forget]? Finally, why you reiterate, like so many others [without any data], that the "Greeks" have benefited ? Frankly, very littele is known about Greek poverty outside, and inside this country...

ReplyDelete@Anonymous

ReplyDeleteIt is quite common, here as well, for people who profit from government pork, that they are not really profiting from it, and more so when things go wrong as to distantiate themselves from the mess.

(ie: "What ?? *I* did not buy this house I cannot afford, but before the crap hit the fan, I was really happy to claim it was *my* house")

I certainly think alot of Greeks did not profit, pre-collapse. Those who had a negative economic relationship with the government certainly did not. Those who chipped in more than they took out, if they even took anything at all, out.

Are these in the streets now ?

PS: BTW, 40% of the GDP is public spending. Gimme a break.

One point I read on another blog, is that the reason why so many Greeks feel like victims, is that even those who are on the state's payroll don't profit that much from it as they are so many of them so they paychecks are measly -- 40% of GDP is government.

ReplyDeleteThat's one point I'd be ready to concede.

@Francis

ReplyDeleteIt's 49.5% with the EU27 average being 50.3% (2010 figs) Can we start getting some numbers right? Pls??

@yiorgos

ReplyDeleteEven 40% is awful IMO.

C'mon Francis - the guilty claim they are innocent. The innocent also claim -they have to-they are innocent. We cannot derive their guilt from their claims. Can you imagine a criminal system working this way ?

ReplyDelete"Big picture" writes today: "Yes, Greece is a mess.Which begs the question: WHO THE FUCK WOULD LEND A DIME TO THESE PEOPLE?" Well, I will tell you who - the people who knew better, the people with the risk management skills, polished by expensive degrees in accounting and financial maths. The big political parties have quite a few economists with ...university jobs in their teams. Very few spoke up, and nobody persisted.These are the people, to quote a line from a Hollywood movie I forget, who "are paid to worry".

I do not altogether agree with The Big Picture. Populism, there is some of it everywhere. Greece has not, however, developed the antibodies to counter it. This is a huge problem. But the other extreme [blame-the-Greeks] seems to me "reverse populism", or populism for the lender countries, a bit racist, and a bait-and-switch tactic to exonerate the lenders. Should we exonerate them?

Economics doesn't matter. Only psychology does. There are lots of children and only a few mature (non-childlike) sociopaths. It's the same in all societies. The sociopaths win.

ReplyDelete> But what Europe shares with the Greek political class is a crisis of top-level vision, execution and consent. The elite in Athens, one eminent local commentator admits freely, "has always floated above the people. But nobody minded. They got rich, we got rich. We never cared that they were unaccountable. But now they're still floating up there, adrift, separate from the people: but everybody's getting poorer."

http://www.guardian.co.uk/commentisfree/2011/jun/30/today-greece-gucci-elite-eurozone

Amen to that, so fucking right, though sociopaths win more in Greece!

DeleteAnother fine article. I would also blame central banks tho for encouraging the creation of these debts. Nevertheless, yes Greece is an example of how dangerous the Keynesian experiment is.

ReplyDeleteχαίρεται... όχι πως είναι το πιο σημαντικό στοιχείο... αλλά όσο αφορά την έρευνα για το ποσοστό ατόμων που ψηφίσαν στις εκλογές καλύτερα θα είναι να χρησιμοποιήσεις τη στήλη "VAP turnout" καθώς μάλλον ανταποκρίνεται πιο σωστά σε αυτό το οποίο αναφερόσουν ως ποσοστό ανθρώπων που συμμετείχαν στις εκλογές. Η διαφορά είναι ότι στο στον ένα λόγο διαιρείς με το σύνολο των ανθρώπων που είναι γραμμένοι στους εκλογικούς καταλόγους και στη δεύτερη περίπτωση με τον αριθμό των ανθρώπων που έχουν δικαίωμα ψήφου. Το γιατί δεν ταυτίζονται δεν το ξέρω και δε θα προσπαθήσω να το μαντέψω καθώς και το ότι ο εκλογικός κατάλογος έχει περισσότερα άτομα από το σύνολο των ατόμων που 'χουν δικαίωμα ψήφου τα περισσότερα έτη.

ReplyDelete@Kalamaria

ReplyDeleteΑς far as the Putin "urban myth" about lenting us money, have you read this->

http://olympia.gr/2011/07/14/%C2%AB%CE%B7-%CF%81%CF%89%CF%83%CE%AF%CE%B1-%CE%AD%CE%B4%CE%B9%CE%BD%CE%B5-%CE%B4%CE%AC%CE%BD%CE%B5%CE%B9%CE%BF-%CE%B7-%CE%B5%CE%BB%CE%BB%CE%AC%CE%B4%CE%B1-%CE%B1%CE%B4%CE%B9%CE%B1%CF%86%CF%8C%CF%81/

But I guess your comments are credible and the one from the Russian Douma are not.

http://citypress-gr.blogspot.com/

ReplyDeleteAnonymous of 17:41,

ReplyDeleteThank you for pointing us to the nationalistic roumor mill... err I mean to the esteemed website named olympia.gr regarding the infamous Russian loan proposal.

May I point you to a slightly more researched article on the same issue in this blog that hosts our comments?

http://lolgreece.blogspot.com/2011/08/self-aggrandising-bullcrap.html

A few points:

ReplyDelete1. Greece didn't exist in a vacuum. According to the IMF data you post, a similar boom in debt/GDP ratios occurred between 1980 and 1995 in all sorts of EU countries (although Greece was near the top admittedly) implying a European if not global trend. It is far from obvious however where that money went. I remind you that after 1984, PASOK implemented a *hard* austerity policy that saw real wages plummet back to where they were in 1980. And then the real blowup in the Debt/GDP ratio occurs under the Mitsotakis government, hardly a shining beacon of worker-friendly policies, eh? Everyone seems to be forgetting the huge private sector bailout of the "problem enterprises" (a large part of Greece's industrial base at the time) which went under and were rescued by the state, in a flurry of leftist rhetoric no less (that was one of the wonders of Andreas Papandreou). It is hard to evaluate but I would assume (I have no numbers on this) that it was a factor in the 80s debt explosion...

2. I'm not sure what your point is regarding voting abstention patterns, but given the notoriously unreliable Greek voter rolls there's not much that can be proven by them. In fact even the 2004 elections had a real abstention rate of not over 12% (simple calculation here - in Greek I'm afraid). So electoral participation in Greece had declined from stellar to pretty impressive by 2004. As I said: not much one can derive from that, given the concurrent similar trends in most western democracies

3. The assessment of democracy in Greece had a lot to do with the first successful passing of government to a, rhetorically at least, left leaning government, without tanks rolling or a coup staged. It was a seminal event in modern Greek history and the level of freedom of speech after Papandreou's election one has to admit was unprecedented. Thus there was proof positive of a really functioning democracy. Economics had very little to do with it.

4. The Olympics and the whole Simitis eurobubble thing was sold hard by pundits and Serious People in pretty much all of the (corrupt) media as proof positive that Greece is now a Strong Country. That the electorate didn't see past this BS and notice that they were being screwed, is sad but it is the spin doctors of "Iskhiri Ellada" that should be skewered. I can remember no one apart from sections of the left that was pointing out at the time that growth through borrowing isn't really a sustainable idea (as I can remember few apart from the left noticing the Athens Stockmarket scam until after it crashed). Now, media disinformation or at least inattention *is* a problem in a democracy. Not one easily attributable to the masses though...

5. You omit comparing public expenditure in Greece with that of other EU countries. Historically Greece is (http://1.bp.blogspot.com/-QHf8199zvvo/TplIRMi5WtI/AAAAAAAAAgk/neJ7HxU9umA/s1600/dapanes.jpg) near the bottom of the list. I'm not sure what the expenditures' graphs you present are supposed to be showing though: From what I can see public spending was pretty much flat over the past 25 years, and public employee wages were near flat at the same time that total employment was increasing. Meaning that per capita portion of GDP per public employee must have been declining, no?

ReplyDelete6. Even if the wage bill is higher that the EU average as % of GDP, this is *entirely* due to the huge amounts being spend on army personnel and police officers. As (http://www.social-europe.eu/2011/09/greece-to-sack-150000-public-sector-workers-for-the-sake-of-our-children/) Andrew Watts points out:

"The EU data also allow us to look at a breakdown of the public sector wage bill by broad function. They do not suggest that the problem is overmanned Greek social-security offices doling out benefits. Greece spends a full percentage point of GDP more than the Euro area average, and considerably more than any other country, on paying its soldiers, sailors and airmen. It is also a big spender, in relative terms, on public order and security. In contrast the wage bill in the area of social security is rather below the euro area average."

7. If one takes into account EU trends(and S.European ones especially - (http://streetlightblog.blogspot.com/2011/09/what-really-caused-eurozone-crisis-part.html) it is rather hard to make the case that the crisis in Greece is principally locally produced.

I'll stop here, it's much too large a comment anyway. Sorry for taking up so much space...

(Omitted: The electoral abstention calculation here: http://histologion-gr.blogspot.com/2006/10/blog-post_18.html )

ReplyDeleteNice summary. Well done! Now have a look at these:

ReplyDeleteConsumption (Greeks first in Eurozone!)

http://epp.eurostat.ec.europa.eu/statistics_explained/images/4/46/Consumption_expenditure_of_households_%28domestic_concept%29.png

Taxation (Greeks last in Eurozone!)

http://img69.imageshack.us/img69/5620/taxesa.jpg

"...it shows that PPP-adjusted income in Greece was higher, pre-crisis, than that of Germany"

ReplyDeleteWhere did you see that? According to the table 14.900 euros (2004) represent 73.6% of the (per capita) Greek GDP while 14.100 euros represent 55.8% of the German GDP. Which implies that Greek GDP_2004 = 20244 euros while German_GDP_2004 = 25268.

"the poorer a population the greater the percentage it tends to direct to consumption of necessary goods and services, assuming similar levels of social security provision (lest someone quote China to me). Similarly, the poorer a population, the greater the percentage of consumption directed towards food"

Don't only focus on the percentages. The Greeks were not only first in consumption as % of the GDP but also in consumption per capita (PPS). At the same time they were contributing the least in taxes as % of GDP. Doesn't that smell massive scale tax evasion?

Now that is the GDP per capita in Purchasing Power Standards:

ReplyDeletehttp://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&plugin=1&language=en&pcode=tsieb010

Germany (2005): 116% of the EU27, Greece (2005): 92% of the EU27 (a cross-check 116/92 ≃ 25268/20244)

van

ReplyDeletekastamonu

elazığ

tokat

sakarya

LMT7J

yozgat

ReplyDeletetunceli

hakkari

zonguldak

adıyaman

MYS

Adıyaman Lojistik

ReplyDeleteTrabzon Lojistik

Muğla Lojistik

Bayburt Lojistik

Bayburt Lojistik

KYZWX

F38E8

ReplyDeleteİzmir Evden Eve Nakliyat

Kripto Para Borsaları

Karaman Evden Eve Nakliyat

Kütahya Evden Eve Nakliyat

testosterone propionat

order fat burner

Bitlis Evden Eve Nakliyat

Malatya Evden Eve Nakliyat

Silivri Duşa Kabin Tamiri

4741D

ReplyDeleteÇanakkale Evden Eve Nakliyat

Uşak Evden Eve Nakliyat

Kastamonu Lojistik

Keçiören Parke Ustası

Giresun Lojistik

Kilis Parça Eşya Taşıma

Giresun Şehirler Arası Nakliyat

Mardin Lojistik

Aptos Coin Hangi Borsada

C66C2

ReplyDeleteizmir canlı sohbet bedava

bursa görüntülü sohbet uygulamaları ücretsiz

aksaray bedava sohbet

uşak ücretsiz sohbet siteleri

bilecik mobil sohbet sitesi

bitlis görüntülü sohbet canlı

amasya ücretsiz sohbet uygulaması

amasya ücretsiz sohbet siteleri

tokat ucretsiz sohbet

ertrehytrrrrrryhtujytij

ReplyDeleteشركة عزل اسطح

gfhgynj

ReplyDeleteشركة مكافحة حشرات بالاحساء

FBEF97676F

ReplyDeleteTelegram Coin Botları

Telegram Farm Botları

Telegram Coin Botları

Telegram Para Kazanma Grupları

Binance Hesap Acma

1481196D85

ReplyDeleteinstagram telafili takipçi

instagram beğeni satın al

aktif takipçi

tiktok takipçi

fake takipçi